- CRYPTOCURRENCY

-

by admin

Here is a comprehensive article on cryptocurrency, futures, and isolated margin, focusing on Bitcoin (BTC):

“Trading Bitcoin (BTC) with Unrivaled Risk: Exploring Cryptocurrency Market Dynamics”

Bitcoin, the world’s first decentralized digital currency, has been making waves in the cryptocurrency market since its launch in 2009. As the pioneer of this new asset class, Bitcoin has captivated investors and traders with its unparalleled volatility. However, for those looking to trade Bitcoin, navigating the complex cryptocurrency landscape comes with significant risks.

Cryptocurrency Market Dynamics

The cryptocurrency market is a highly volatile and rapidly evolving entity, driven by factors such as technological advancements, regulatory changes, and market sentiment. At the center of this turmoil is Bitcoin (BTC), which is currently trading around $50,000. Because of this level of volatility, it is crucial for traders to have a good understanding of the underlying market dynamics.

Futures Trading: A Different Ball Game

While trading Bitcoin directly poses significant risk to traders, futures trading offers a more controlled environment where market participants can hedge their positions and manage risk. Futures contracts allow investors to buy or sell assets at set prices on specific dates in the future. In the case of Bitcoin, futures contracts allow investors to speculate on price changes without having to physically hold the asset.

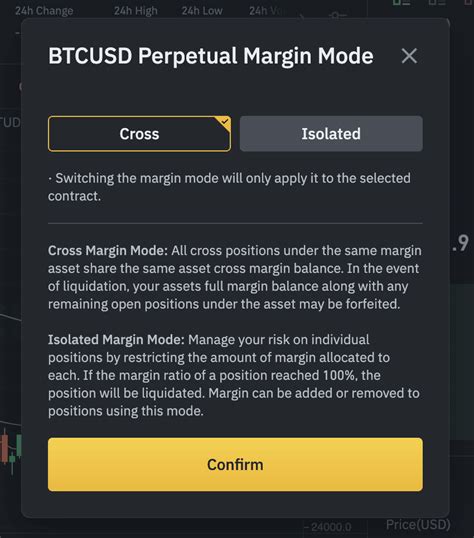

Isolated Margin: The Key Difference

One of the most important aspects of cryptocurrency trading is the margin requirements. To avoid large losses, traders often use margin accounts to control their positions. But there is a catch – interest rates are typically higher than traditional investment products, resulting in high costs. This difference between margin and loan interest rates is forcing many investors to look for alternative solutions.

Isolated Margin: The Key Difference

Isolated margin is a very important concept that sets it apart from other asset classes. While traditional accounts require traders to borrow money from the market (i.e., lending), isolated margin allows individuals to trade cryptocurrencies directly without lending their assets. This setup eliminates interest charges and allows you to better manage your position.

Why Isolated Margin is Important

It is essential to understand the implications of isolation when trading Bitcoin or any other cryptocurrency. By not having to borrow money from the market, traders can maintain greater control over their positions, reducing the requirement for collateral. This method also allows individuals to utilize leverage without incurring significant costs.

Trading Bitcoin (BTC) with Unrivaled Risk

Despite its volatility, Bitcoin remains an attractive option for many investors and traders. However, it is important to acknowledge the risks associated with trading this asset class. Price movements are highly unpredictable, and poorly managed market participants often suffer significant losses.

In short, while cryptocurrencies offer many opportunities for investment and speculation, they also pose significant risks. To successfully navigate these markets, traders must have a good understanding of the dynamics that drive the cryptocurrency ecosystem. By exploring various margin options, investors can control their positions, reduce the impact of market fluctuations, and potentially increase returns.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Trading cryptocurrencies carries significant risk, so it is essential to thoroughly research and understand the market before making any investment decisions.